- Home

- Justifying Capital Investment for a Renewable Diesel Unit

Justifying Capital Investment for a Renewable Diesel Unit

June 03, 2022

What problem was the client facing?

Our petroleum refining client has the same majority shareholder as another smaller petroleum refining company. As the smaller refiner had a recent success in breaking into renewable fuel production, the shareholder began to put pressure on our client to follow suit. The problem was: our client didn’t know what this would cost to execute. With a combined 7 inland refinery/biodiesel plant sites all over the country, they needed a TIC (total installed cost) estimate to understand what site would make most sense for a renewable diesel unit “RDU” (including hydrogen unit and pretreatment unit for feedstock). Along with site selection our client wanted to evaluate different RDU technologies that could offer them the flexibility to process different feedstocks and maximize the plant throughput.

What were their options to fix the problem?

In 2018, our client reviewed and assessed all refineries for the potential of having a renewable diesel unit, whether revamp or grassroots. In 2019, they assessed building a grassroots plant but decided against it at that time.

Fast forward to 2021, and our client finds itself deeper in need to finalize their feasibility assessment for a renewable diesel unit. Based on initial research, they narrowed their locations down to three sites for further evaluation: Texas, Arkansas, and Louisiana. These locations were selected based on initial screenings of site equipment availability and logistic evaluation. This initial level of effort engineering exhausted all their internal resources in further evaluating the viability of a capital investment for an RDU.

Why was KPE selected to provide the solution?

The decision of which location to build the RDU at would be dependent on which site’s TIC estimate was the most economical, and which site would provide our client with the greatest return on investment (ROI). Because our client was aware of our work on the renewable diesel unit for HollyFrontier, now HF Sinclair (NYSE: DINO), we were selected to participate in the study. KPE also offers a wide variety of experience in RDU technology evaluation, which was a critical requirement of this study. Along with technology evaluation, we have developed unique technical understanding of pretreatment units (PTU), which is an important derivative for catalyst selection, throughput, and cycle-run between turnarounds. Beyond the technical expertise, this refiner had hired KPE for 24 jobs since 2004, so they were aware of our deep experience in developing estimates for multi-million-dollar EPC projects.

What did KPE propose as the solution?

KPE completed an FEL-01 Process Study and factored +/-50% TIC estimate to assist our client with building their business case to justify a capital investment and completed preliminary engineering to establish project feasibility for a Renewable Diesel Unit. The study report included:

Summary of findings and conclusions: Different blends of feedstocks were evaluated that set the Hydrogen demand for the plant. Additionally, several low, medium and high carbon intensity (CI) feedstocks were characterized ad evaluated within the study.

Three major cases were shortlisted and examined:

- Revamp of an existing Distillate Hydrotreater (DHT) to a single-stage 7,000 BPD RDU with addition of some new equipment (reactor, feed drum) and 7,000 BPD pre-treatment unit.

- Revamp of an existing Distillate Hydrotreater (DHT) and Gasoil Hydrotreater (GOHT) to a two-stage 12,000 BPD RDU with addition of some new equipment (feed drum) and 12,000 BPD PTU.

- Grassroot 12,000 BPD PTU, RDU and 30 MMSCFD of Hydrogen unit.

Technical due diligence: Provided an overview of the front end PTU technology (Alfa Laval and Applied Research Associates), followed by downstream RDU technologies (UOP’s Ecofining and Topsoe’s HydroFlex) being considered and infrastructure necessary for the proposed cases. Recommendation was based on technology improvements, efficiency, and operating performances.

Considerations that impact project estimate and economics: Included ISBL (PTU, RDU and Hydrogen supply) and elements that reside OSBL such, as tankage, utilities, ancillary units, and logistical areas such as truck racks, rail, and barges.

Environmental commentary: Discussed potential environmental aspects of the project and considerations for further development and future operation of the project. Following key risks such as undertaking Phase 1 Environmental Site Assessment (ESA) to identify any compliance requirements, regulatory reviews associated with railroad or barge dock improvements were made.

What were the results?

The process study determined that the most economical location for our client to build a renewable diesel unit was their site in Arkansas.

KPE did an in-depth review of the licensors (Topsoe and UOP) submitted which outlined for each location requirement to integrate their technology for each facility. Using this information, we evaluated Topsoe’s proposal to account for new required equipment, plot plans, pricing of equipment (new), logistics, and pretreatment/hydrogen requirements and cost.

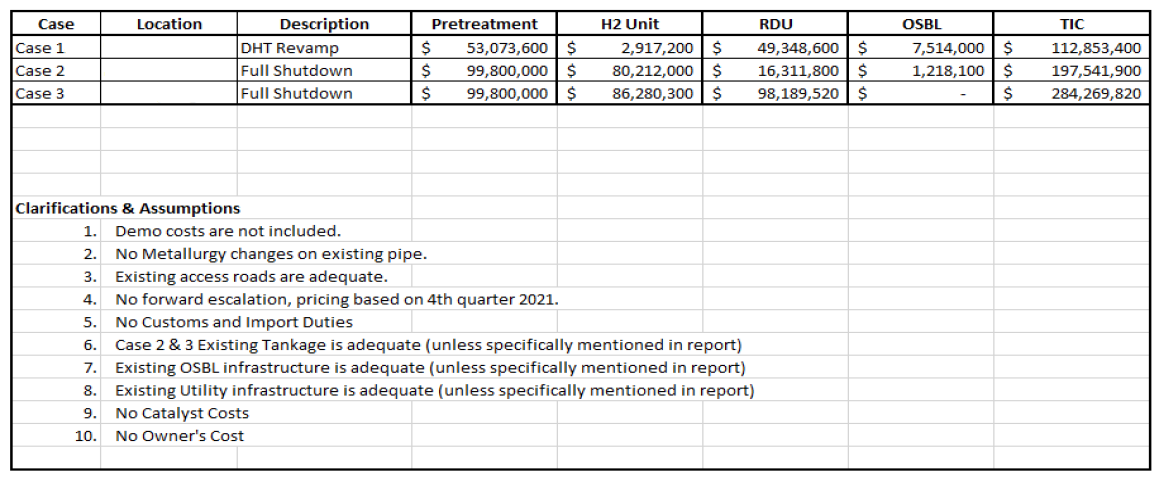

The study determined the results as outlined below:

Louisiana location (Case 3) was determined to be a “stranded” asset (an idled asset that isn’t profitable). The only option here would be to build a grassroots plant because the existing facility would not support a revamp based on available equipment and process units.

Arkansas location (Case 1 and Case 2) was ideally cheapest because of existing assets.

Leverage our decades of experience in hydrotreating on your next renewable diesel project.